Combine the best of artificial and human intelligence

accuracy in data and information extraction

years of IP combined with the latest AI innovations

documents processed

languages supported, empowering customers globally

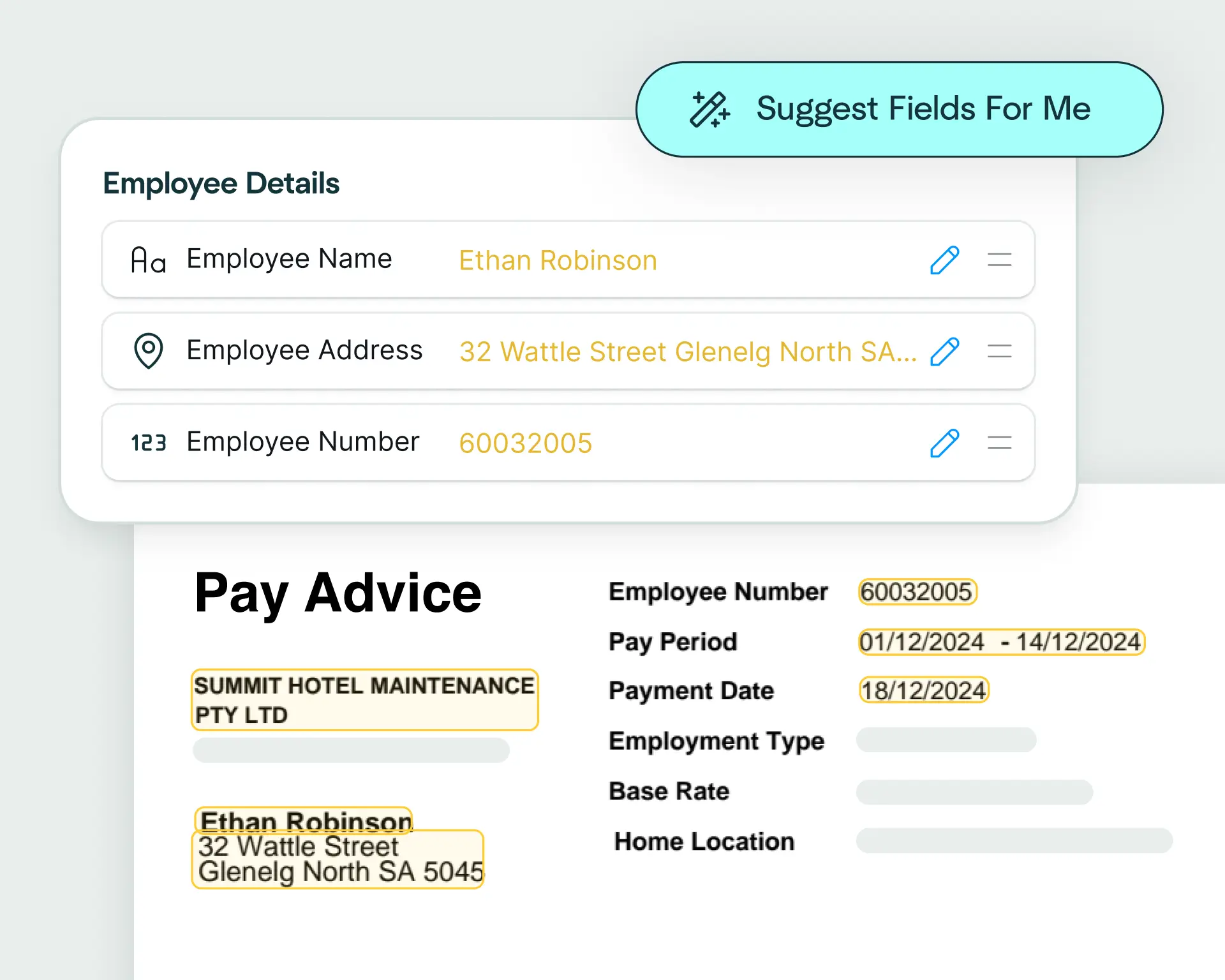

Upload a check and watch as Affinda instantly predicts the data fields you want to extract, helping you automate check processing in just a few clicks.

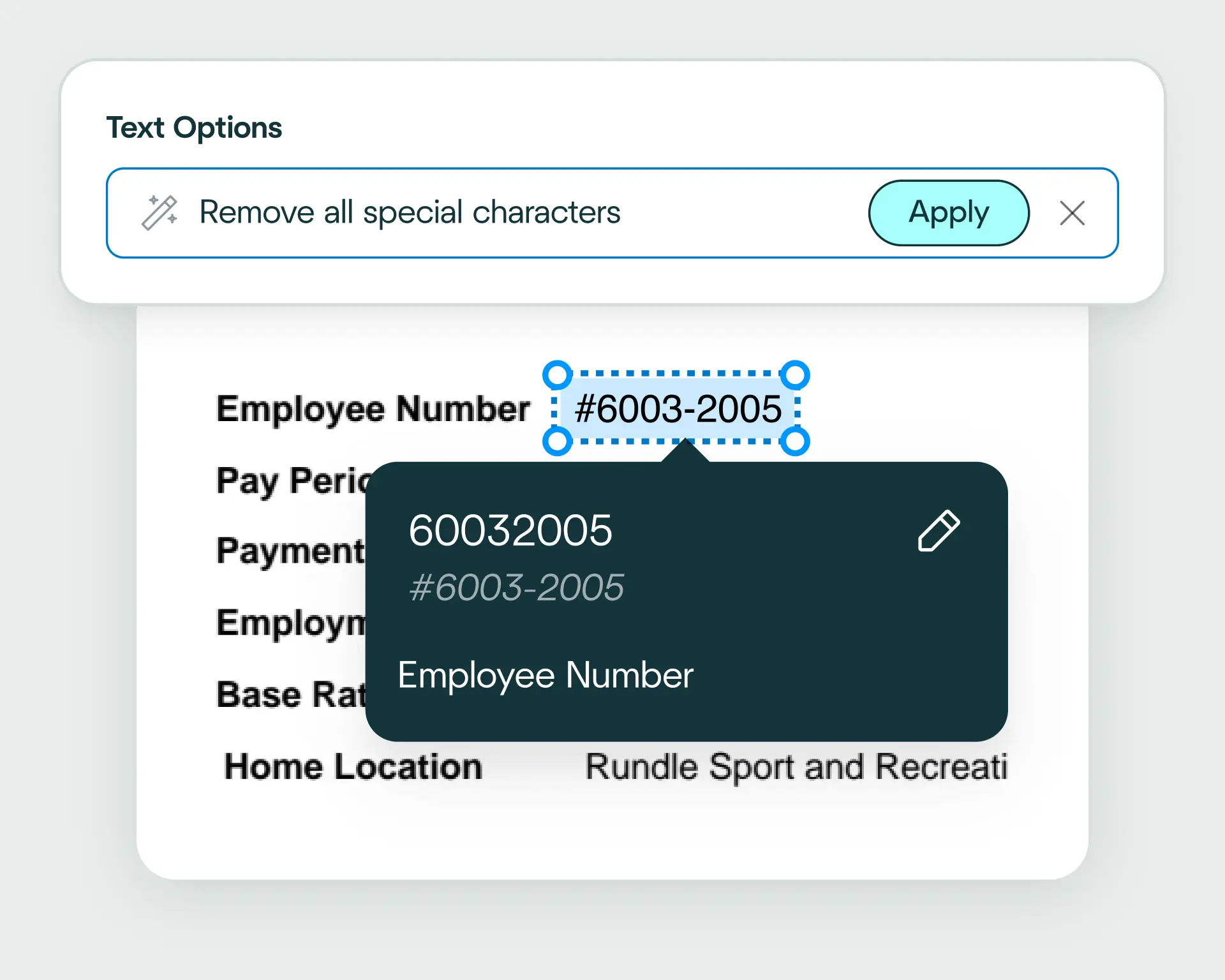

Affinda automatically converts extracted check data into the format your banking, payment or accounting system needs – ready for immediate processing. Want custom output? Just describe how you need the data structured, and Affinda adapts to match.

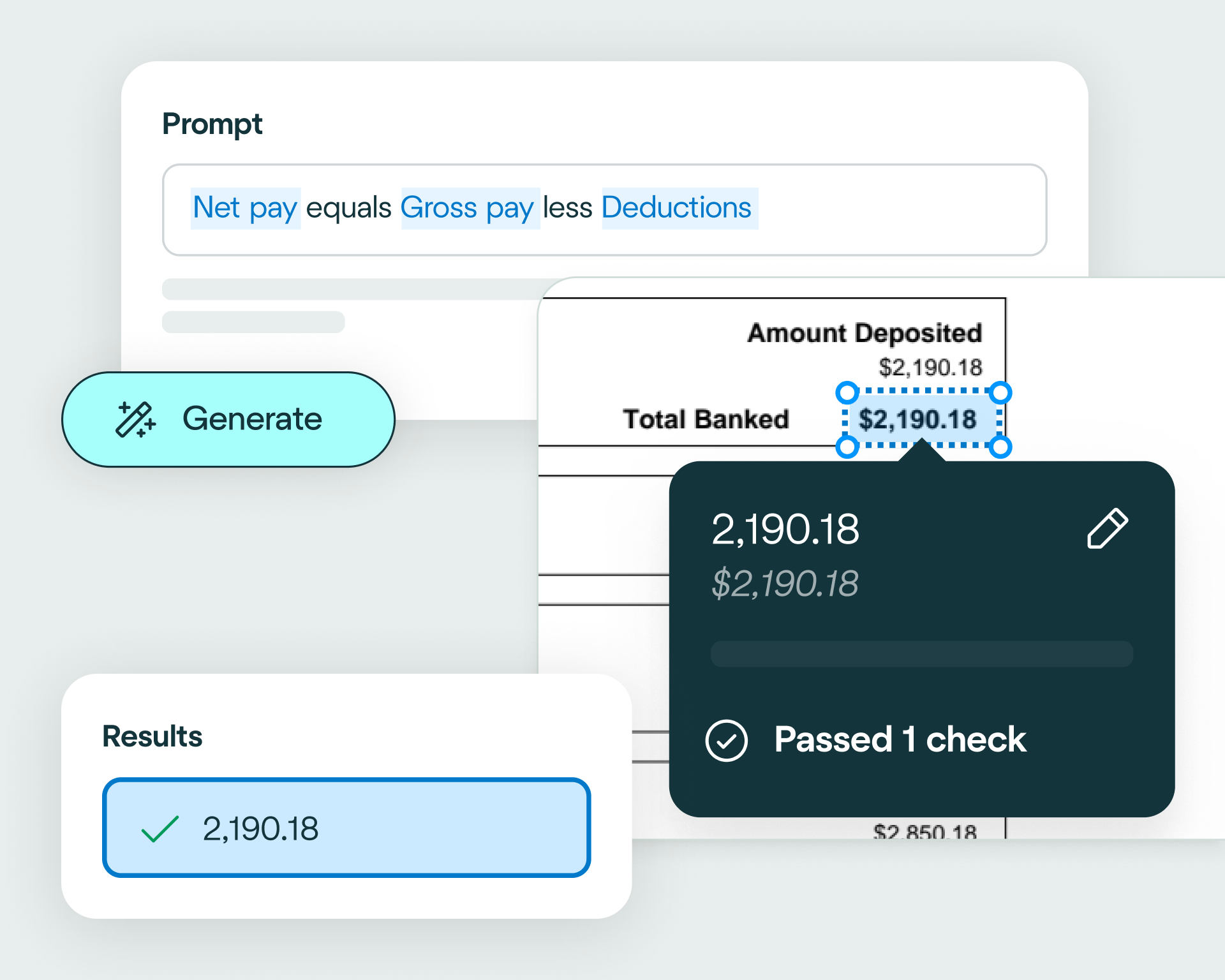

Write validation rules in plain language and apply your business logic to the extracted data. This ensures accuracy, reduces fraud risk and enables automated check processing without manual review.

Create integrations with ease, even if you're not a developer. Choose from 400+ business systems and describe how you want your check processing integration to work, using natural language. Affinda's AI Integrations Agent will generate the code to make it happen.

Easily connect Affinda with your systems using our client libraries. Automatically generate type-safe Pydantic models or TypeScript interfaces tailored to your check processing needs.

accuracy in data and information extraction

years of IP combined with the latest AI innovations

documents processed

languages supported, empowering customers globally

With a free trial, discover how easy it is to extract any information from any document, fast.

Affinda has removed the laborious workload from our accounts staff, who now focus on quality assurance and management of any outliers.

- Nathaniel Barrs, CTO, PSC Insurance

reduction in manual work

more invoices processed with no added staff

Enhanced auditability and tracking of invoice approvals

Customer satisfaction is always our top priority, and Affinda has helped us achieve that by eliminating phone calls, manual handling, and delays.

- Jorg Both, Head of Business Systems, Northline

proof of delivery documents processed annually

of documents straight-through processed in the first weeks

Automatic validation of documents against ERP system

Affinda's ongoing improvements in its AI models demonstrate its innovative approach in Document AI.

– Michael Zhao, AI Product Manager, SEEK

Affinda’s support and expertise were invaluable… The experience working with Affinda was excellent.

- Nick Tran, Business Analyst, StateCover Mutual

documents processed annually

different document types

Enhanced auditability and tracking of invoice approvals

The results have spoken for themselves. I recommend Affinda to anyone looking to enhance their product or business with AI capability.

- Steve O’Keeffe, CTO, Felix

reduction in manual data input

reduction in compliance data errors

compliance documents processed annually

Bank check processing is the workflow financial institutions use to capture, extract and validate data from checks – including account details, amounts, dates, payees and signatures. Our AI bank check data extraction software automates this entire process to reduce fraud risk, speed up clearing times and improve reconciliation accuracy. It ensures payments are verified and recorded correctly across core banking and accounting systems.

Bank check data extraction is the process of reading a check and capturing the essential data points (such as check numbers, account holders, amounts, dates, payees and signatures). Our platform uses advanced AI to automate bank check data extraction, handling both handwritten and printed fields to turn unstructured documents into structured data ready for your core banking, payment and accounting systems.

Bank check extraction is the automated capture of essential data from checks using AI. Our bank check extraction software combines reading order models, OCR, LLMs, RAG and more to process handwritten and printed fields with exceptional accuracy and speed across your payment workflows.

A bank check parser is a software tool that reads checks and extracts key data automatically. It converts both handwritten and printed checks into structured, machine-readable formats ready for your systems. Our AI bank check parser learns from every check it processes, adapting to different formats, layouts and handwriting styles while delivering the exact output structure your banking and payment systems require.

Bank check line extraction captures key data fields from checks – such as routing numbers, account numbers, check numbers and amounts and dates – and structures them into a machine-readable format. Our AI processes these fields with precision, preserving the relationships between data points to ensure accurate integration with your banking and payment systems.

Affinda's AI bank check processing software can extract data from any field on a check – whether handwritten or printed. Standard data fields include:

Need to capture custom fields or match a specific check template? Define them in the UI or describe what you need in plain language and Affinda will extract and structure them automatically.

Our AI agents can process any file type. Supported file types include PDF, JPG/JPEG, PNG, TIFF, DOC/DOCbank check (Word), bank checkLSbank check (Excel), HTML and Tbank checkT/CSV.

Affinda's AI agents read, extract and validate bank check data. Our platform is intuitive to set up and easily integrates into your systems. Simply:

The result? Faster, more accurate bank check processing with minimal manual input.

Yes. Our AI bank check processing platform combines OCR with retrieval augmented generation (RAG), LLMs, agentic workflows, proprietary reading order algorithms and more, to automatically detect and process data from scanned or photographed invoices (PDF, JPG, PNG). Even low-quality images are automatically enhanced for reliable data capture and processing.

Our AI bank check processing platform can automatically detect and process bank checks in 50+ languages, including multilingual checks containing more than one language. Supported languages include: Afrikaans, Albanian, Amharic, Arabic (Standard, Egyptian, Sudanese, Algerian, Moroccan, Levantine), Bahasa Indonesian, Bengali, Bhojpuri, Bulgarian, Burmese, Chinese (Mandarin [PRC/Taiwan], Cantonese, Wu, Min Nan, Jinyu, Xiang, Hakka), Croatian, Czech, Danish, Dutch, English, Estonian, Finnish, French, German, Greek, Gujarati, Hebrew, Hindi, Hungarian, Italian, Japanese, Javanese, Kannada, Korean, Latvian, Lingala, Lithuanian, Macedonian, Malayalam, Marathi, Nepali, Norwegian, Odia, Persian (Farsi), Polish, Portuguese, Punjabi (Western and Eastern), Romanian, Russian, Slovak, Slovenian, Somali, Spanish, Swahili, Tagalog, Tamil, Telugu, Thai, Turkish, Ukrainian, Urdu, Vietnamese, Yoruba.

Absolutely. Our AI bank check processing platform integrates with 400+ downstream systems, including core banking platforms, payment processors and accounting software. You can build no-code integrations using our AI integrations agent, or create custom connections with our APIs – whatever works best for your workflow.

AI bank check processing helps automate and optimize payment workflows across financial operations such as:

A bank check optical character recognition (OCR) data extractor scans and captures information from checks with exceptional accuracy, handling both handwritten and printed fields. Upload check documents in PDF, JPG or PNG formats. The OCR technology converts the documents into a text layer, ensuring all text (including handwritten amounts, signatures and account details) is captured. Affinda's AI models then identify and extract key fields such as check numbers, dates, payee names, amounts (numeric and written), bank details, routing numbers, account numbers and signatures, transforming them into structured, usable data.

This automation eliminates manual data entry, reduces errors and speeds up payment processing. Once the check data is captured and structured, our AI bank check processing pipeline can apply machine validation and post-processing to enable seamless integration with core banking, payment and accounting systems.

Banking, finance, payroll and payment processing organizations rely on Affinda's AI for check clearing, fraud detection and reconciliation workflows, improving accuracy and operational efficiency.